Operating margin formula

The gross margin equation expresses the percentage of gross profit Percentage Of Gross Profit Gross profit percentage is used by the management investors and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales. Operating margin is calculated with the same formula as gross margin simply subtracting the additional costs from revenue before dividing by the revenue figure.

Airbnb Rental Income Statement Tracker Monthly Annual Etsy Rental Income Airbnb Rentals Being A Landlord

According to our formula Christies operating margin 36.

. The operating cash flow can be found on the. However the elements involved can vary. It can be further expanded as shown below Degree of Operating Leverage Formula Sales Variable cost Sales Fixed cost Variable cost Explanation.

A second approach to calculating DOL involves dividing the contribution margin by the operating margin. Operating Profit Net Sales Operating expenses. Net profit revenue growth and operating profit margin.

Both values can be obtained from the Income statement. Net Operating Income Total Revenue Cost of Goods Sold Operating Expenses. The formula for Gross Margin can be calculated by using the following steps.

Sales - Total Expenses Revenue x 100. The formula for this is the same regardless of industry. Operating Margin Operating Income Revenue X 100.

The gross margin formula is as follows. Here is how Christie would calculate her operating margin. Gross Profit Margin Total Revenue Cost of Goods SoldTotal Revenue x 100.

Firstly determine the COGS of the subject company during the given period. Gross Margin 38. Often administration and personnel costs are where.

Operating Profit Margin formula. The profit margin formula is. Next figure out the cost of goods sold or cost of sales from the income statement.

Gross sales are the total revenue earned by the company. Operating costs are expenses associated with the maintenance and administration of a business on a day-to-day basis. Gross margin Total revenue Cost of goods sold Total revenue x 100.

The equation or formula of contribution margin can be written as follows. Operating income before tax netted to 45 million after deducting all 80 million in operating expenses for the year. Explanation of Operating Income Formula The operating income is the gross profit or profit generated by the company minus operating expense which includes selling general and administrative expenses amortization depreciation of assets rent salary of employees insurance commission postage expense and supplies expense.

Net margin is an important number to know about any company you plan to invest in. DT Clinton Manufacturing company reported on its 2015 annual income statement a total of 125 million in sales revenue. The formula for Operating Profit Margin is similar to other profitability ratios.

Relevance and Uses of Net Operating Income. An Operating Margin Example in Use. Which are included in the operating margin calculation.

Formula Contribution margin EBIT. Operating Leverage Δ in Operating Income Δ in Revenue. The second component in the above operating margin formula is net sales.

Determine the operating profit margin. Therefore you can use the operating leverage to quickly calculate the impact of changes in sales on your operating income without having to prepare detailed financial statements. Net income or net profit may.

We start the income statement with the gross sales. Now compute the percentage change in sales initially by deducting the. Finally the formula for net operating income can be derived by subtracting the cost of goods sold step 2 and other operating expenses step 3 from the total revenue step 1 of the company as shown below.

The formulas for the two necessary inputs are listed below. The cost of goods sold is how much it costs your business to sell those goods. Contribution margin Sales revenue Variable expenses.

But to find out the net sales we need to deduct any sales return or sales discount from the gross sales. You can then calculate the operating profit margin by following this formula. And comparing a companys margin to its competitors can show.

This gross margin formula gives a percentage value. Profit margin is a profitability ratios calculated as net income divided by revenue or net profits divided by sales. If not managed properly these indirect costs can really eat into a companys profit.

Gross margin formula. The total revenue is how much your business makes out of net sales. Using this information and the formula above we can calculate Electronics Company XYZs operating margin by dividing 4000 operating earnings by.

The formula for the operating expense can be derived by using the following steps. Gross profit margin is a financial metric used to assess a companys financial health and business model by revealing the proportion of money left over from revenues after accounting for the cost. From the data given above calculate contribution margin and net operating income of Fine Manufacturing Company for the year 2017.

To see how operating margin works take a look at the hypothetical income statement for Electronics Company XYZ. Operating Cash Flow Margin. Contribution margin Sales revenue Variable.

Gross Margin Formula Example 2. The operating cost is a component of operating income and is usually reflected. We take Operating profit in the numerator and Net sales in the denominator.

COGS is the aggregate of cost of production that is directly assignable to the production process which primarily includes raw material cost direct labor cost and. Let us understand the formula for Operating Profit. This means that 64 cents on every dollar of.

Operating Earnings Revenue Operating Margin. Next determine the sales during the current year and the previous year. For company XYZ with an operating leverage of 7 net profit margin should increase by 70 percent with a 10 percent increase in sales.

As you can see Christies operating income is 360000 Net sales all operating expenses. Using the net margin formula we divide the 30000 net profit by the 100000 total revenue to obtain our net margin percentage. The formula to calculate gross profit margin as a percentage is.

Cost of goods sold beginning inventory purchases - final inventory. For the year ended. What is the formula for Operating margin.

Operating margin is a margin ratio used to measure a companys pricing strategy and operating efficiency. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. The net profit margin tells you the profit that can be gained from total sales the operating profit margin shows the earnings from operating activities and the gross profit margin is the profit remaining after accounting for the costs of services or goods sold.

Or if revenue fell by 10 then that would result in a 200 decrease in operating income. Firstly figure out the net sales which are usually the first line item in the income statement of a company.

I Found This Formulae Very Helpful It Shoes Four Different Ways Of Calculating Degree Of Operating Leverag Contribution Margin Financial Management Fixed Cost

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business

Target Profit Pricing Meaning Methods Examples Assumptions And More Accounting And Finance Accounting Principles Financial Management

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

The Difference Between Gross Profit Margin And Net Profit Margin Net Profit Profit Company Financials

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Accounting And Finance Finance Investing

Entrepreneurship Archives Napkin Finance Financial Literacy Lessons Finance Investing Small Business Planner

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

Pin On Airbnb

How To Analyze And Improve Current Ratio Accounting Books Financial Analysis Accounting And Finance

Operating Margin Ratio Operating Margin Financial Analysis Finance Investing

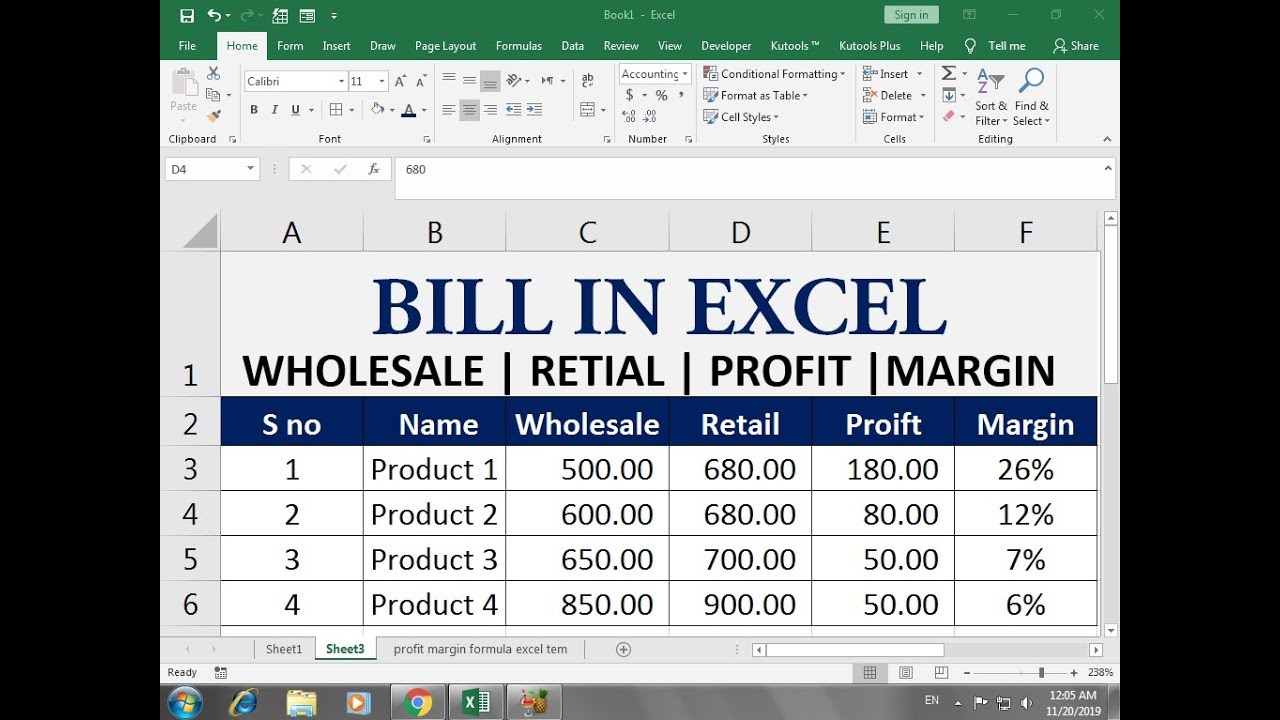

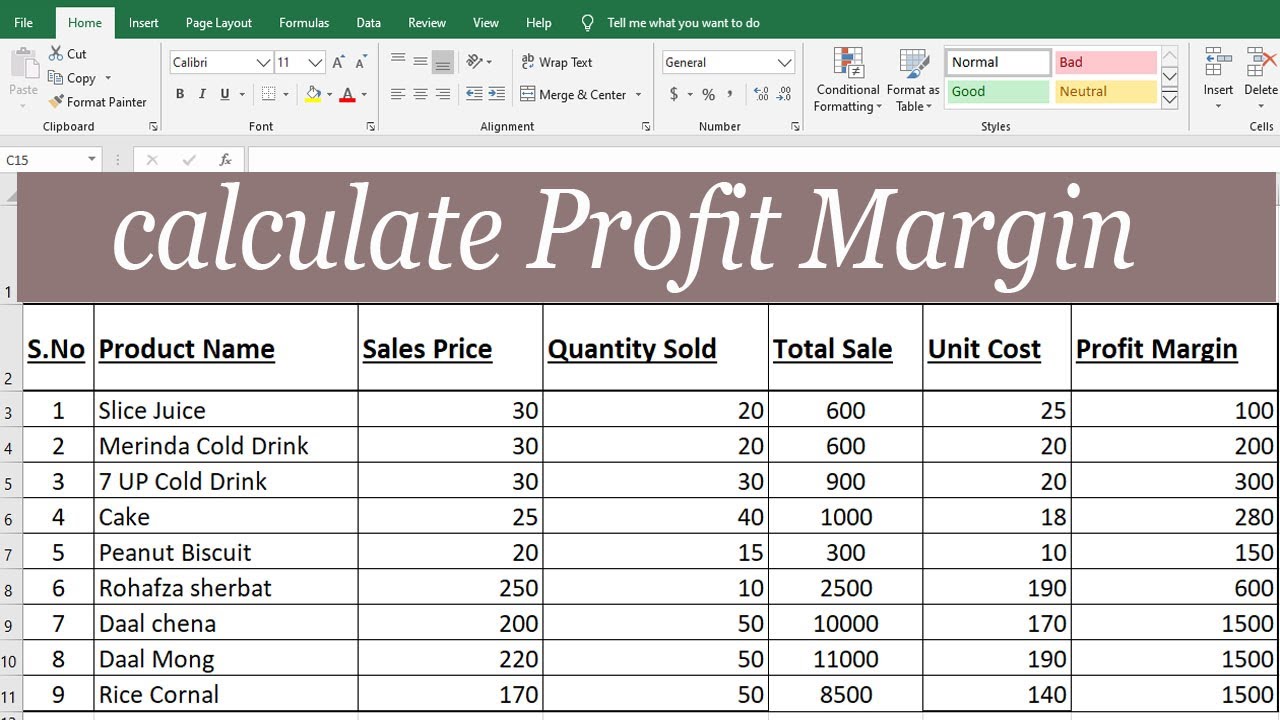

Calculate Profit Margin With Percentage In Excel By Learning Center In U Excel Tutorials Learning Centers Excel

Excel Sales Bonus And Profit Margin Calculation By Learning Center Learning Centers Learning Free Learning

Cvp Analysis Guide How To Perform Cost Volume Profit Analysis Financial Statement Analysis Financial Analysis Analysis

Operating Leverage A Cost Accounting Formula Cost Accounting Increase Revenue Business Risk